Portfolio software is the Swiss Army knife for long-term investors who want to increase their profits and minimize their risk. There are several utilities that are very effective for this kind of tool, and also some pitfalls that you should avoid. You can check this useful reference to know more about risk management software online.

Read this article on to learn more.

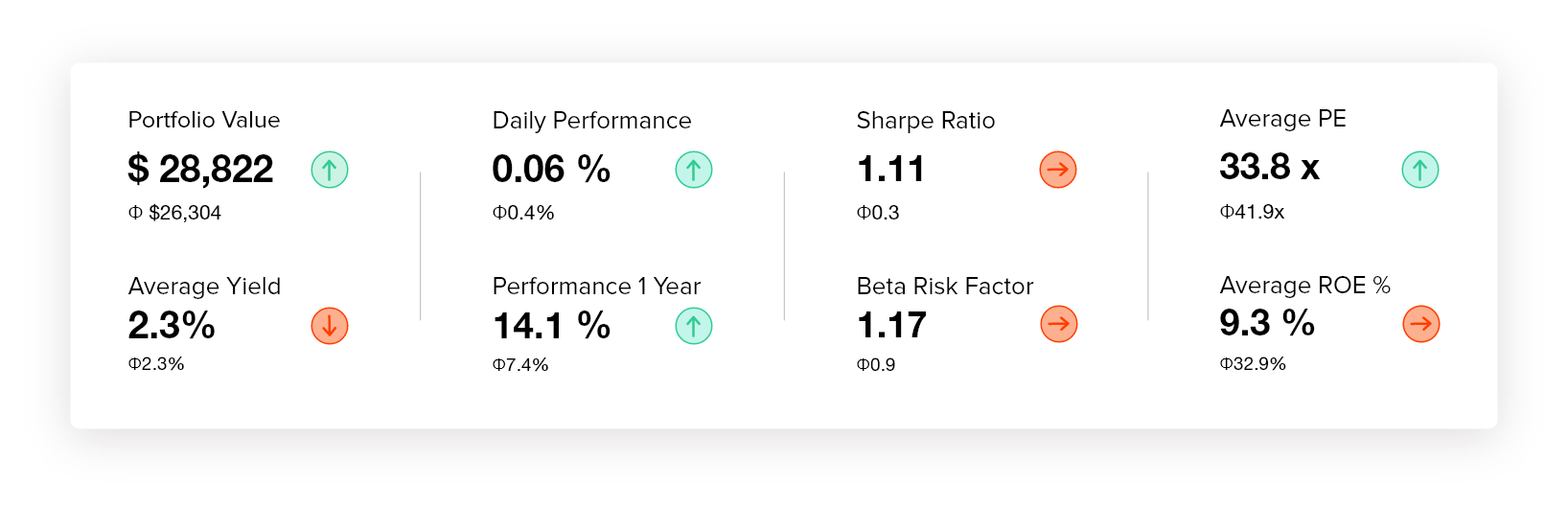

Benchmarking exercise was conducted to determine how the portfolio investments made on the market in the past. Analysts can use the results to project the expected future assuming there will be no investment or structural market changes. Over the longer horizon this type of analysis is often useful.

Another use of this type of risk management software online is "what if" decisions about the securities could add higher returns or reduce risk in the portfolio. This is the kind of scenario analysis that has two main approaches, including simulation optimization (finding the optimal amount of stock X, Y, and Z), and user-defined scenarios (what happens if I add 1000 A bond stock to my portfolio).

This analysis requires a large amount of historical data return time series, or at least the beta, volatility or correlation matrix data as input to the calculation, and many more.